The Revival of Keynesianism?

From The Wall Street Journal to Foreign Policy, everyone seems to agree: Bidenomics contains more of John Maynard Keynes than Milton Friedman. But what does that mean? We have summarized the background and underlying theories in a reading list.

John Maynard Keynes and His Theory

Related Summaries in getAbstract’s Library

Current Affairs and “Keynesian” Ideas

Engineering of Economies

Related Summaries in getAbstract’s Library

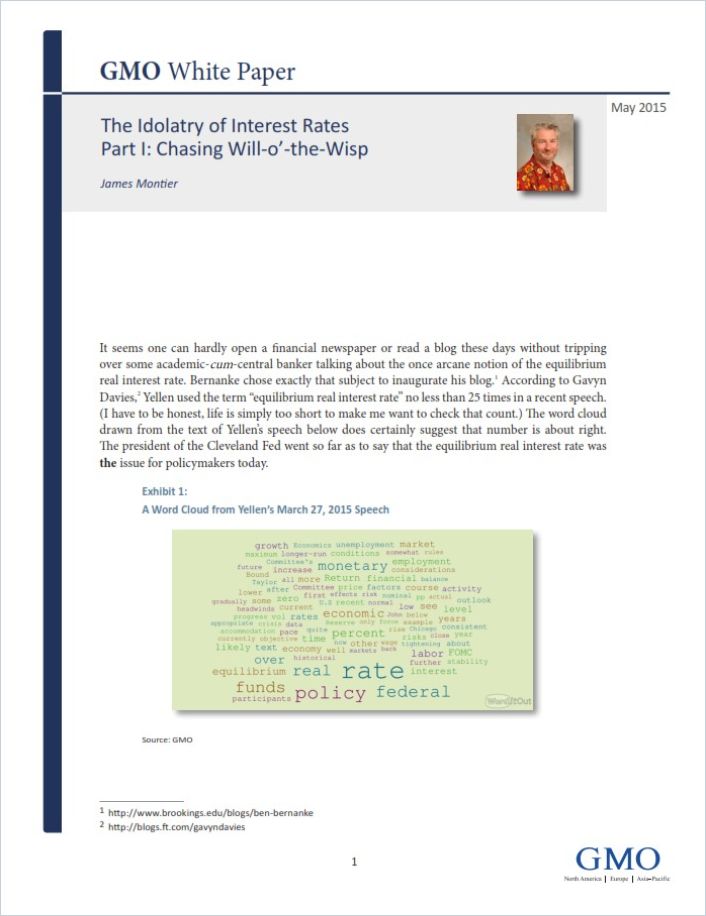

Monetary Policy and Debt

Related Summaries in getAbstract’s Library

Article Summary

Accepting the Reality of Secular Stagnation

Finance & Development Magazine Read Summary

Article Summary

EU Debt as Insurance Against Catastrophic Events in the Euro Area

Bruegel Read Summary“Bullshit Jobs”

Related Summaries in getAbstract’s Library

Economic Critique of Keynesianism

Related Summaries in getAbstract’s Library

Further Reading

Related Summaries in getAbstract’s Library

How the Journal Saves You Time

Reading Time

1

min.

Reading time for this article is about 1 minutes.

Saved Time

146

h

This article saves you up to 146 hours of research and reading time.

Researched Abstracts

31

We have curated the most actionable insights from 31 summaries for this feature.

8

8 Articles

19

We read and summarized 19 books with 7293 pages for this article.

4

4 Reports