The Next Killer Investment Might Wipe You Out

Psychologist Maria Konnikova, also a poker champion, says in The Confidence Game that the best cons are the ones no one ever discovers, and that even the smartest people can be fooled by swindlers. It’s human nature to seek advantage, human nature to be trusting and human nature to have a bias towards optimism. These are all characteristics con artists look for. Fraudsters usually share a “dark triad” of personality traits: Psychopathy, Narcissism and Machiavellianism.

The Architecture of a Con

Konnikova notes that although cons have different details, the basic building blocks are the same:

- In the “put up,” the con zeroes in on a mark and learns everything about them.

- In the “play,” the con establishes and builds an emotional connection, often flattering the mark’s ego.

- During the “rope,” the con has the mark hooked and implements his scheme.

- At the “convincer” stage of the operation, the con lets the mark win. This lowers their guard for the next, even bigger scheme.

- During the “breakdown,” the grifter takes over and the mark wonders if something’s gone wrong.

- This sets up the “send and the touch” when the con offers reassurances then gets the mark to commit to even higher stakes.

- Finally, at “the blow-off and the fix,” the con takes the money and runs, blowing off the mark. Often the victim of a con is so embarrassed they don’t report the con.

Konnikova talks about the ease with which con artists lie. Most people find it stressful to lie, but it’s second nature to swindlers, who often lie to themselves as well. She wryly notes that technological advances beget more complicated grifts.

It Starts with the Hype

As author Gabrielle Bluestone points out in Hype, an account of fraudster Billy McFarland and the infamous Fyre Festival he organized, the most important aspect of a con is that it appears legitimate, at least enough to gain a person’s initial interest. McFarland promoted the Fyre Festival as an exclusive, high-ticket concert event in the Bahamas, but instead it was a total con. Although many of the marketing materials for the event were amateurish, buzz built quickly, spearheaded by celebrity influencers. In the end, when ticket-holders arrived on the island, they found tents set up without lights and no entertainment. That was the moment many of them realized for the first time they’d been conned. The Securities and Exchange Commission (SEC) believes McFarland raised $27.4 million to finance the festival. He spent over $600,000 on personal purchases, and that’s just what prosecutors are aware of.

After arrest, while awaiting trial for this scam, McFarland sent out an offer to his Festival email list for VIP access to high-ticket events like the Met Gala and Burning Man. He made over $100,000 in six months from the same people he previously duped, before he was caught.

Ponzi, the OG Swindler

The “original gangster” of financial shenanigans, the man other similar swindles take their name from, is Charles Ponzi. Ponzi was a petty criminal long before he promoted himself as an investor.

As author Mitchell Zuckoff recounts in Ponzi’s Scheme, Ponzi set up Securities Exchange Corporation and prospered in the 1920s. But his scheme to make huge returns based on the difference in price between countries of International Reply Coupons, used to buy stamps, was pretty far-fetched. In reality, he used monies from new investors to pay dividends to previous investors, a set up now known as a “Ponzi scheme.” Ponzi spent four years in jail, but once out and awaiting other charges, he set up “Charpon Land Syndicate” to sell swamp land in Florida. He was eventually deported to Italy, and died penniless in Brazil after World War II.

Like a magician who focuses his audience’s attention on one hand while performing feats of prestidigitation with the other, Ponzi knew that the details of the transactions were less interesting than the promised results.

Mitchell Zuckoff

Ponzi may have been inspired by Ivar Kreuger, the “match king.” Kreuger arrived in New York City during the 1920s financial boom. He owned the Swedish Match Company along with other investments from which he paid investors 25% dividends. He and an associate set up a labyrinthine trail of corporate assets to hide cash and escape oversight. His scheme got more elaborate as he went along, since he promised investors impossibly high, consistent rates of return.

Even during the market crash of 1929, Kreuger’s seeming confidence in his own businesses gave his New York partners confidence in his Midas touch. But it was unwarranted. As the financial crisis deepened, investors wanted a closer look at his books. For the first time they asked how boxes of matches, sold for a halfpenny each, added up to multimillions. Of course, they didn’t. His legitimate partners went bankrupt and Kreuger committed suicide. Ironically, the Swedish Match Company he established still operates profitably today and employs 12,000.

Ivar believed that if he kept raising cash to pay earlier debts his businesses would grow fast enough to survive, even if they continued to pay high dividends.

Frank Partnoy

As author Dan Davies writes in Lying for Money, when a company is growing very quickly, investors should do meticulous due diligence. Generally, white-collar criminals know as much about running a legitimate business as any good manager would and are usually in the same social class as those who prosecute financial crimes. They are disarming; they engineer their schemes to happen in the places people aren’t looking.

Human nature was asserting itself; in the absence of hard evidence, too good to miss trumps too good to be true.

Frank Partnoy

The Genius Investor

Another famous swindler, Bernie Madoff, also had a prosperous, legitimate investment business while he ran a multibillion-dollar Ponzi scheme through a secretive hedge fund. According to business consultant Jim Campbell in Madoff Talks, he told clients he had a secret formula for getting higher than average returns for his investments, a combination of “split strike conversions” and perfect marketing timing, but in fact he was paying off early investors with money coming in from new investors. At the time the SEC caught on, analysts estimate his fund was worth $65 billion.

Ponzi schemes come with an insatiable appetite for more cash.

Jim Campbell

Madoff got caught because a competitor couldn’t replicate his earnings record. Former securities executive turned fraud investigator Harry Markopolos writes in No One Would Listen about how he gradually came to the conclusion that Madoff was running a scam. Markopolos reported Madoff for investigation to the SEC in 2000, but they asked the wrong questions; they investigated Madoff five times before charging him with fraud. Only when the 2008 market downturn left him exposed and investors wanted to pull their money from his fund did Madoff get caught. Despite a prosperous legitimate business, Madoff’s high-flying Ponzi scheme, once set in motion, was impossible to stop. His partners in crime also made it impossible to just walk away.

The damage done by Madoff was reverberating throughout the financial markets of the world, as well as in millions of homes. In an instant, thousands of people had been financially devastated.

Harry Markopolos

The takeaway for Markopolos was how important it is for the US Congress to revamp financial regulations to curb scams, and for the SEC to retool its oversight, hire more financial experts, and incentivize whistle-blowers who provide evidence of large-scale fraud.

The Telecom Bubble

While most tech journalists were covering the bursting dot-com bubble in 2000, author Om Malik was following the “broadband meltdown” sparked by the big telecom corporations. In Broadbandits he reports that when the broadband bubble burst, investors lost $750 billion and 600,000 employees lost their jobs, along with the wealth they’d accumulated in company stocks. On top of this smoldering heap of people who lost out, telecom executives Bernie Ebbers of WorldCom and Joe Nacchio of Qwest made out like, well, bandits.

In the mid-1990s, as people flocked to the internet, telecoms positioned themselves to build out the fiber optic network to support the traffic. Telecom executives like Ebbers and Nacchio hyped the demand erroneously claiming the number of internet users doubled every 100 days. This led to frenzied investment but also a glut of capacity that went unused. As demand weakened, share prices plummeted.

Even as they were cashing out their own holdings, the executives at these broadband companies encouraged employees to put their 401(k) dollars into company stock. And since the employees had nary a clue about these shenanigans, they complied and are now ruined.

Om Malik

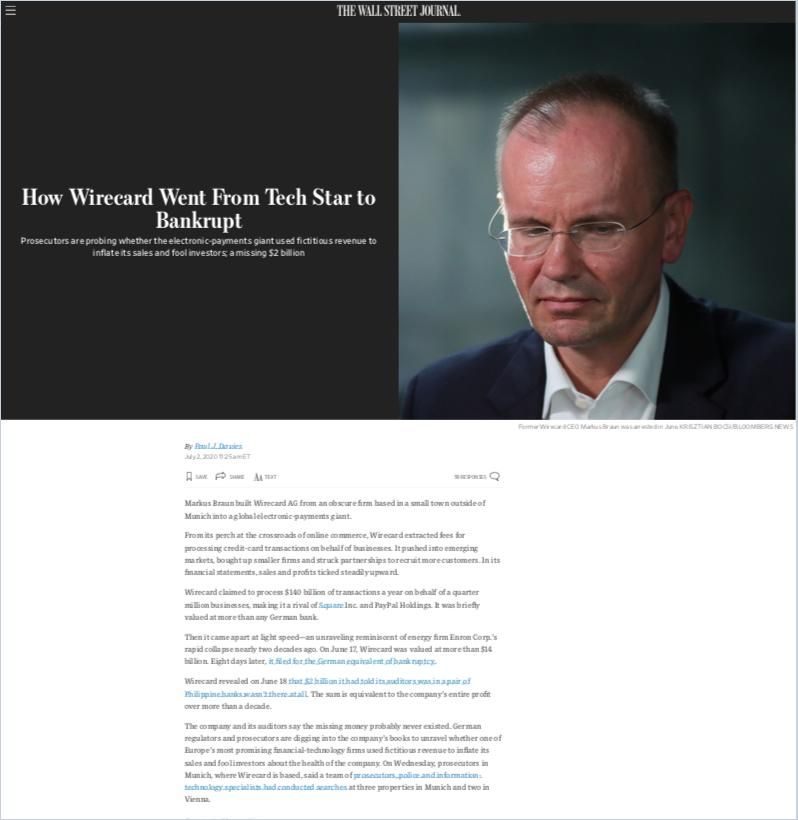

Because most investors didn’t understand the technical language surrounding broadband, they relied on pundit recommendations rather than due diligence. WorldCom hid their financial troubles in a flurry of paperwork associated with new acquisitions – something energy company Enron, also entering the broadband market, did as well – with the help of disgraced accounting firm Arthur Andersen. Qwest used the same tactic to deceive, and today it looks like the German digital payment company Wirecard also hid financial shenanigans this way.

Why would CEOs worry about anything other than boosting the stock price – because the higher the stock prices, the richer they got.

Om Malik

In 1998, Ebbers took over competitor MCI in a $37 million deal. The trouble was, both MCI and WorldCom combined had revenues of only $28 million. To stay afloat, WorldCom resorted to overbilling customers then delaying credits due them, and paying vendors late. Friendly pundits kept hyping their stock. When regulators blocked a WorldCom merger with Sprint in 2000, Ebbers’s house of cards began to tumble. With closer scrutiny, it was easy to see WorldCom’s books were cooked, hiding serious financial weaknesses.

[Wirecard] was briefly valued at more than any German bank. Then it came apart at light speed – an unraveling reminiscent of energy firm Enron Corporation’s rapid collapse nearly two decades ago.

Paul J. Davies

The Ground Floor of the Unicorn Start-Up

Theranos founder Elizabeth Holmes’s fraud trial is a media sensation, a dramatic story of the unraveling of an entrepreneur and a company so many placed so much hope in. For 15 years, Theranos attracted millions from high-profile investors like Rupert Murdoch, Henry Kissinger and Betsy DeVos, and big names for its board of directors like Bechtel Group chairman Riley P. Bechtel and former US Secretary of State George Shultz. Tyler Shultz, his grandson, ultimately blew the whistle on the company’s fraud. In 2018, the Securities and Exchange Commission charged Holmes and Ramesh “Sunny” Balwani, her business and romantic partner, with fraud. The company dissolved shortly thereafter.

As journalists Rebecca Jarvis, Taylor Dunn and Victoria Thompson outline in their ABC podcast series The Dropout, Holmes claimed that Theranos developed a revolutionary technology that could run hundreds of medical tests on a single drop of blood. It promised to disrupt the home medical care industry.

She was charming and convincing, and early supporters were dazzled.

Rebecca Jarvis, Taylor Dunn and Victoria Thompson

Holmes founded her company in 2003 at the age of 19 and within the first year attracted $16 million in seed funding. Journalist John Carreyrou, writing for The Wall Street Journal in 2015, pegged the company’s value at $9 billion. In his subsequent book Bad Blood: Secrets and Lies in a Silicon Valley Startup, he wrote about all the red flags along the way. When chief financial officer Henry Mosley confronted Holmes about her lies, she fired him on the spot. Early partner Pfizer stopped working with Theranos after consistently unreliable results from its Edison prototype. Although Walgreens, the pharmacy chain, planned to put Theranos machines in its stores nationwide, Holmes wouldn’t let executives tour the lab or compare Theranos test results with the nearby Stanford lab. However, Carreyrou notes, despite doubts at Walgreen’s highest levels, executives were worried if the deal fell a competitor would beat them to market. Grocery chain Safeway CEO Steve Burd bet early on Theranos, sinking $100 million into redesigning stores to accommodate blood testing, a move that ultimately forced him to resign.

Holmes got away with her scam for so long due to her bravado and salesmanship – she mimicked Apple founder Steve Jobs’s style, down to his trademark black turtleneck. She also kept a tight lid on a secretive work culture intolerant of dissent. She falsified statements and tests and built counterfeit machines to convince investors her revolutionary technology worked. Nobody wanted to miss out on the hottest new start-up with another wunderkind founder. People believed her because they wanted to believe her.

Sophisticated Crimes Call for Sophisticated Oversight

Often law enforcement organizations are just not equipped to investigate sophisticated swindles. In Gatekeepers, author John C. Coffee, Jr. describes some of the conflicts of interest auditors, analysts and other securities professionals grapple with, and offers some remedies to bolster the ability of professional gatekeepers to more effectively uncover corporate malfeasance and hinky bookkeeping. Start with censure for complicity in wrongdoing by the professional associations these actors depend upon for their good reputations. Learn more about difficulties government agencies face when looking into corporate fraud and other criminal activities in this enlightening interview with Coffee:

Also, the next time you hear a clever pitch promising astronomical returns, remember what your grandmother told you: If it sounds too good to be true, it probably is.