Supply Chain: What’s in Store?

Do you remember the times when you visited three stores to buy dishwashing soap? Or wondered while your local grocery store ran out of frozen dinners? Or obsessed about the missing screw on your exercise bike that seemed to be permanently out of stock? (Check out our October 2021 piece, “Where’s My Stuff?”)

The pandemic caused major disruptions in the global supply chain. COVID lockdowns and labor shortages resulted in production and transportation delays. Uncertain demand patterns and increased online shopping compounded these issues, resulting in product shortages, delivery delays and global inflated prices.

“I’ve Never Seen Anything Like This”: Chaos Strikes Global Shipping

The New York TimesThe disruptions exposed important vulnerabilities. The strong dependence of the auto industry on just a handful of Taiwanese semiconductor manufacturers, for example, led to government efforts to shore up production at home. Companies, meanwhile, started to question whether the short-term cost savings of just-in-time logistics really outweigh the risk of running out of supplies in the face of even short delivery delays.

As with most pandemic-related changes, going “back to normal” is not in the cards for the supply chain sector. Transformations in the field, however, are spurred less by post-pandemic reckoning but more by the rapid development of new technologies to help supply chains become more efficient and stable.

Automation

Robotic process automation (RPA) technology has made great strides in automating routine tasks, including product selection, warehousing, packaging and handling, leading to increased efficiency, reduced errors and lower labor costs.

In Arriving Today, Christopher Mims traces the journey of a hypothetical USB charger from a Vietnamese factory to an American customer’s doorstep. Once containers leave a ship, he writes, automation handles much of the process. Here is an excerpt from our summary:

At the Port of Los Angeles, longshoremen secure the ship to the pier as the quay buzzes with activity. A ship-to-shore crane, one of the few port machines requiring a human operator, lifts containers off the ship. Robots, AI and algorithms then take over at the port’s TraPac terminal. Automated straddle carriers, or autostrads, carry the containers away. Eventually, machines load the containers onto trains or trucks, which carry them to a consolidation center and then to a distribution center.

Advanced automation, however, also brings new challenges to the sector. While automation helps ameliorate labor shortages, the lack of digital skills among the existing workforce remains a major pain point in the industry. As discussed in a recent McKinsey podcast episode, the sector needs to attract digital talent to deal with increased analytics requirements and impart new technical skills to existing employees. Companies that succeed at doing so will be able to reap the many benefits new technologies bring to the sector.

Advanced Analytics

Advanced analytics, predictive models and machine learning algorithms enable better demand forecasting and inventory management. The result: less overproduction and fewer stockouts, leading to significant cost savings.

In Big Data in Practice, Bernard Marr describes how Walmart leverages big data to ensure it does not run out of products that fluctuate in demand. In 2004, Walmart’s algorithms flagged correlations between warnings of a major hurricane and increased demand for strawberry toaster pastry, allowing the retailer to stock and sell more before subsequent storms.

In the new era of “intelligent automation,” machines use AI to augment human decision-making and problem-solving. Rather than focusing purely on productivity gains, advanced analytics combined with AI can identify patterns and predict risks, such as potential supplier failures, quality issues or demand fluctuations. This allows companies to proactively manage these risks.

In The Digital Supply Chain Challenge, the authors explain how advanced analytics can reduce food waste. Waste of fresh products often occurs due to too much inventory, ordering too frequently and not accounting for delivery time. Collecting high-quality data over time helps anticipate demand and control orders. Furthermore, deploying real-time sales data allows the supply chain to react to demand changes. Finally, use of automation, such as inventory management and order processing, can help eliminate congestion and order delays. Automation thus helps prevent excessive inventory, long delivery times, food spoilage and waste.

Blockchain

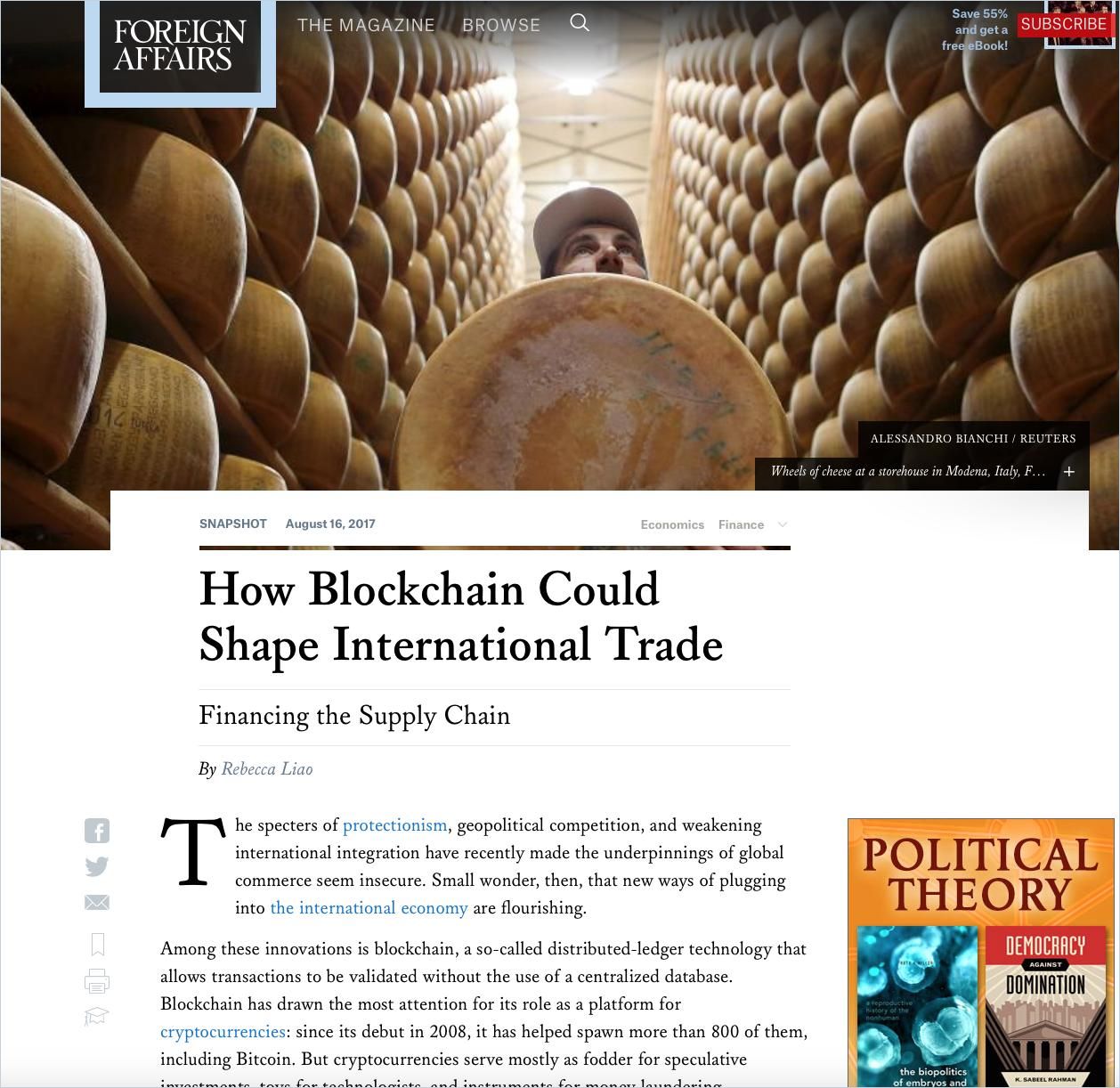

Blockchain technology can create a secure, transparent and immutable ledger of transactions, improving trust and traceability in the supply chain. Blockchain allows multiple users simultaneous access to instantly updated records. Blockchain also integrates with automation and allows for the aggregation of data. Walmart, for example, uses blockchain to increase transparency in labeling, sustainability and food safety.

What Problems Will You Solve with Blockchain?

MIT Sloan Management ReviewA Deloitte report describes the example of a shipping company using blockchain for freight tracking. Traditionally, the process involved extensive paperwork and was susceptible to fraud at multiple stages, resulting in significant maritime fraud annually. Through collaboration with customs authorities, the shipping company used blockchain to create a secure and transparent record of transactions and approvals, simplifying the approvals process and significantly reducing transportation time. According to one estimate, use cases like these have the potential to reduce shipping timelines from one week to a few hours.

Real-Time Tracking

Using the Internet of Things (IoT), products can be tracked by embedding sensors or tags in them that communicate with connected devices, enabling the tracking of products in real-time throughout the supply chain. For example, by providing real-time data, IoT enables logistics systems to optimize shipping routes by identifying and addressing recurring bottlenecks and supply chain issues. Furthermore, IoT platforms enhance communication and information-sharing between suppliers, vendors and customers, enabling transportation companies to anticipate and plan for changes in supply and shipment orders.

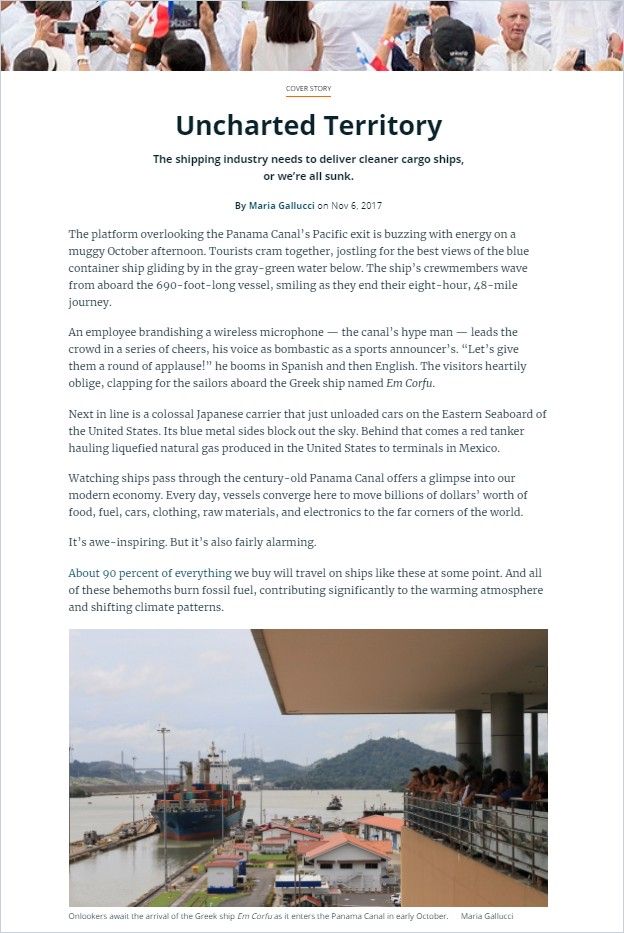

Real-time tracking is becoming of significant importance for environmental, social, and governance (ESG) initiatives in the supply chain. Monitoring carbon emissions, for example, can help companies implement measures to reduce carbon footprints. The international shipping industry continues to rely heavily on high-carbon fuel, which makes it a significant contributor to global warming. The International Maritime Organization (IMO) estimates that continued economic expansion will increase the industry’s carbon footprint by up to 250% by the middle of the century. Besides adopting greener vessels, the shipping industry can deploy new digital technology to further optimize fuel usage.

Moreover, having real-time visibility into the entire supply chain allows companies to verify sustainability standards and make informed decisions about sourcing practices. Similarly, companies are better able to verify adherence to fair labor standards throughout the production and transportation process. By demonstrating commitment to ESG principles through real-time monitoring and reporting, companies can build trust with stakeholders, investors and consumers who are increasingly interested in sustainable and responsible business practices.

Sustainability in Retail Is Possible – But There’s Work to Be Done

The Boston Consulting Group Read Summary

Boosting ESG Performance in Today’s Energy Supply Chains

The Boston Consulting Group Read SummaryConclusion

For an industry grappling with labor shortages, supply chains depend on new technology to keep the goods moving. On top of that, new technologies will help make supply chains more resilient and ESG-conform. Some trends the pandemic set in motion may soon fade. Some experts, for example, doubt whether companies will follow through on their intention to relocate some of their manufacturing to the US. Doing so would not only increase production costs but also hurt their valuation. Asset-light companies continue to get favorable treatment on Wall Street, which would change only if supply chain risks are factored into a business valuation.

Another post-pandemic trend, the move away from just-in-time models, may also not be long-lasting. Keeping larger inventories may protect a business from short-term but not long-term disruptions. And large inventories will become a liability as soon as demand plummets, leading companies to second-guess their new inventory-management practices pretty soon. As Yossi Sheffi argues in The Wall Street Journal, just-in-time management, if done right, makes supply chains more – not less – resilient in the long term. Just-in-time models help strengthen communication and collaboration between companies and suppliers, which makes supply chains more agile and better able to respond to disruptions. Of course, new technologies, including real-time tracking and advanced analytics, will support these processes. The supply chain sector’s rapid adoption of these technologies will be here to stay.