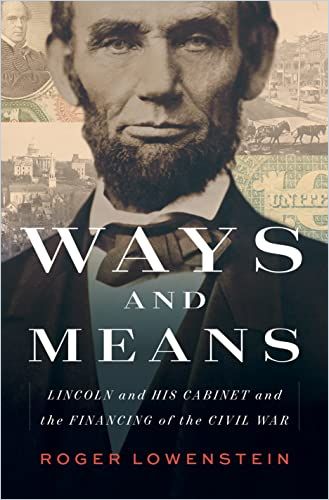

Bestselling economic historian Roger Lowenstein details the fiscal strategies that created the US dollar and won the Civil War.

How the Greenback Beat Dixie

Today, everyone takes paper money for granted. But in 1860, the notion of currency backed by nothing more than the full faith and credit of a government seemed far-fetched, acclaimed journalist Roger Lowenstein reports in this intriguing history of the origins of the US fiscal system. During the Civil War, the North’s adoption of a centralized currency and an income tax – and the South’s inability to follow suit – proved decisive to the war’s outcome, the end of human enslavement in the United States and the nation’s economic development. Lowenstein offers a fascinating, in-depth look at how competing 19th-century economic philosophies transformed the United States’ future.

Hands-Off

Lowenstein describes how, in 1860, the US federal bureaucracy reflected Founder Thomas Jefferson’s vision of a hands-off government.

The United States had no authorization to tax its citizens, no government bank, no currency. The private banking system was atomized and weak.Roger Lowenstein

The Southern states relied on cotton plantations but invested little in capital goods or technological innovations, because human enslavement gave planters free labor. Enslaved people had a market value of $2.7 billion – greater than the combined value of the country’s manufacturing industry and railroads. The North, meanwhile, was becoming a manufacturing hub that sold goods to the South.

Salmon P. Chase

New president Abraham Lincoln named Chase his Treasury secretary. The federal government was in debt, and the South’s secession had reduced Union revenue by 25%. Rebel states raided federal forts, seizing $6 million worth of Washington, DC’s gold and silver. Due to the makeshift system of banknotes issued by private financial institutions, the Union had no way to borrow at the start of the war.

Secession was decided by convention, and the conventions were stacked with planters.Roger Lowenstein

The Confederate constitution – written to preserve the South’s status quo – maintained an agrarian, decentralized system with no governmental power to tax or spend. The region’s thriving cotton trade created an illusion of prosperity. The South foolishly withheld cotton shipments to England and France, believing that European textile industries would collapse and force those nations to recognize the Confederacy.

Both the North and the South reckoned that if a war came, money would be decisive.Roger Lowenstein

In Chase’s first three months, the Treasury brought in $6 million – and spent four times that to feed, clothe and arm the Union Army. Chase issued short-term notes because he thought the war would be brief. By advertising in newspapers, Philadelphia banker Jay Cooke was able to sell $3 million in war bonds in Pennsylvania in 1861.

The Federal Budget

Lowenstein cites Lincoln asking Congress for an annual budget of $400 million – a staggering sum. Chase issued $50 million of short-term “demand notes” that paid no interest but could be redeemed for gold at banks. Chase expected Americans to trade the notes among themselves rather than taking them to the nearest bank for coins. Thus, Chase and Congress unwittingly created a new currency.

Paper money had a history of depreciation, and in Chase, true to his Jacksonian roots, suspicion of paper was second nature.Roger Lowenstein

Chase issued the notes to soldiers, seamen and government employees. Union expenses rose to $1 million a day, and Congress agreed to impose a 3% tax on incomes of more than $80o, which far exceeded most workers’ annual earnings.

The Banking System

Banks in New York, Boston and Philadelphia held private gold reserves worth $60 million. They agreed to lend the Treasury $50 million because Chase promised to pay them 7.3% annual interest. Chase conceived a system of federally chartered banks that would use a national currency, not their own bespoke banknotes.

In 1861, banks were small and entrepreneurial.Roger Lowenstein

Because the South had scant gold with which to back its notes, an inflationary cycle began. Confederate currency was worthless in Europe, but the South needed imports, so it agreed to release cotton as payment for goods to be smuggled into Southern ports.

United States Notes

On February 25, 1862, Lincoln signed a bill introducing a fiat currency; Chase suddenly had the power to print money. The new United States Notes – which were green on the back, hence the name “greenbacks” – could not be redeemed for coin; they were expected to have value of their own.

Today, we scarcely pause to consider that the money in our wallets does not yield a return.Roger Lowenstein

Southern states and cities issued their own scrips, and small business owners hoarded gold and silver. The Central Bank of Louisiana issued a $10 note known as the dix – French for “10” – which spawned the South’s new nickname: Dixie.

A babel of currencies could not finance a national project such as a great war.Roger Lowenstein

Northerners widely accepted United States Notes, which increased the money supply and lowered borrowing costs.

Centralized Government

Lincoln expanded the federal government as Congress imposed tariffs, authorized a transcontinental railroad and took aim at the legality of human enslavement. The Land-Grant College Act of 1862 led to a national system of higher education, from Cornell University to Oregon State University.

The attachment to federalism ran deep, even in the North.Roger Lowenstein

Congress enacted a progressive income tax and lowered the minimum annual income threshold to $600; the top rate of 5% applied to incomes of $10,000 or more.

Hyperinflation

The South couldn’t raise taxes or create a viable currency. In the first nine months of 1863, the Confederate government reported $600 million in revenue: $5 million from taxes, $150 million from long-term bonds and a ruinous $442 million from short-term notes. Chronic shortages arose and inflation ensued. The price of a barrel of flour soared from $5.50 before the war to $38 in April 1863 to $220 in the winter of 1864.

A Lasting Framework

By war’s end, Lincoln and his Republican Party had embraced a Hamiltonian ethos of centralized control. Blood and necessity had transformed the United States from an alliance of self-governing states into a unified nation.

History and Finance

Lowenstein’s revelatory perspective entwines history, strategy, politics and finance, and he demonstrates how inextricable they become in any conflict. But his primary lens is economic. He reveals each side’s policies as inevitable outgrowths of their respective belief systems – one derived from unfettered 19th-century market forces, and the other locked in medieval enslavement. Lowenstein builds an unexpected tension around the development of the US dollar and the random paths that led to it.

Roger Lowenstein also wrote Buffett: The Making of an American Capitalist; The End of Wall Street; When Genius Failed; and America’s Bank.