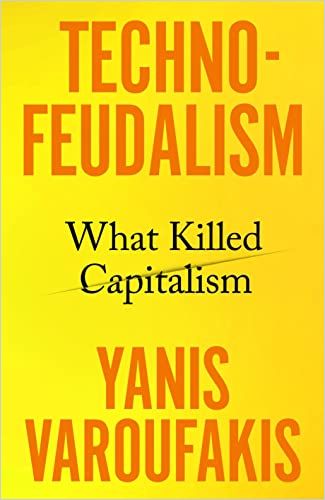

Economist, political leader, and author Yanis Varoufakis accurately depicts the end of individuality under “technofeudalism.”

Economic Overlords

In this bracing takedown of the post-pandemic economy, political leader, economist, and author Yanis Varoufakis argues that “technofeudalism” has squeezed capitalism out of existence. He seeks to deprive Silicon Valley and Wall Street of their power and return it to the individual.

Technofeudalism

Elon Musk, Sergey Brin, Mark Zuckerberg, and Jeff Bezos loom above a system that exploits the masses and funnels the rewards to the top of the feudal system.

What has happened over the last two decades is that profit and markets have been evicted from the epicenter of our economic and social system, pushed out to its margins, and replaced.Yanis Varoufakis

Under technofeudalism, invisible actors commoditize and monetize your identity. Cloud capital has replaced industrial capital. Cloud rent has supplanted traditional profits and turned the masses into serfs.

The Industrial Revolution privatized European land that had been held in common. That nurtured industrial capitalism. The pre-2000 internet was a freewheeling, anticommercial space. Private interests snatched a formerly public virtual commons and now monitor your every move.

The Pentagon turned GPS over to the commons, but if everyday consumers had retained ownership of their identities, getting around would be a different proposition. If you needed a ride to the airport, for example, you could use your GPS coordinates and a transit app to solicit bids for private rides. Instead, travelers move at the mercy of Big Tech firms Uber and Lyft, and you pay with a credit card that Big Finance controls.

Feudal Lords

When the coronavirus pandemic hit in 2020, economies everywhere locked down. In Britain, for example, national income plunged 20%. Yet the pandemic unleashed a financial boom: Central banks slashed interest rates; governments created new money; share prices soared. Amazon posted its best year ever in 2020 while paying no corporate income taxes. Tesla posted no profit in 2020, yet its share price rose from $90 at the start of 2020 to $700 by the end of the year.

Governments sent cash to traditional companies, like Volkswagen and General Electric, which used that windfall to buy back their own shares. Big Tech companies took the cash and invested in the cloud economy, which solidified their position as the center of the postindustrial economy.

Every Gilded Age has seen inequality rise, with the rich profiting faster than the poor.Yanis Varoufakis

The pandemic boom mirrored the wealth shift after the 2008 global financial crisis. Governments placated the financiers who had caused the crash with a torrent of free money, which they invested in real estate or art. Companies buying back shares drove share prices upward, as if the companies were profitable. This enriched the rich and led to the political backlash that manifested in Donald Trump’s election.

Now, the combined assets of the Big Three — the firms BlackRock, Vanguard, and State Street — equal 90% of the shares of nearly every major company that trades on US markets. That total exceeds $20 trillion — the equivalent of the combined national incomes of China and Japan.

The Big Three grew fat on the post-2008 crash government bailouts. Prior to 2009, companies lacked the liquid capital required to take over capitalism. The Federal Reserve engaged in socialism for the very rich, enabling the Big Three to gain untold wealth and financial power. The wealthy put their money in BlackRock, Vanguard, and State Street, which entice them with super-low fees. The Fed saved capitalism by sacrificing it to a few monopolistic feudal lords.

Thanks to Tesla’s stock price rise in 2020, Elon Musk became the world’s richest man. Improbably, he used an Industrial Revoluion-era method — auto manufacturing — to gain his fortune. Musk’s electric cars, satellite company, and rocket operation guarantee him money and attention, but none offered a pathway to becoming a technofeudalist. Twitter did.

Global economy

In the 1970s, US consumers bought electronics from Japan and South Korea, and clothes from China. These Asian governments invested their proceeds in US Treasury bonds, real estate, and derivatives. This “Dark Deal” allowed money and goods to flow across the Pacific while destroying factory jobs in America.

After the 2008 crash, Beijing bailed out Wall Street and invested heavily in emerging nations. China’s own “cloudalists” — including Alibaba, Tencent, and Baidu — became hugely successful. China doesn’t impose limits on its tech firms, and those firms’ access to users’ financial and personal data far surpasses Silicon Valley’s access to its users. China became a technofeudal system; a clash with the United States was inevitable. For example, presidents Biden and Trump sought to impede American tech firms from doing business with Chinese telecom giant Huawei.

Resisting Technofeudalism

As wealth inequality grows more extreme, moneyed elites financialize everything. Leisure time has become the constant work of deciding how and what to share online. With giant tech companies manipulating every thought and opinion, citizens lack self-determination; they’re products to be digitized and sold. Turning off the internet, getting off social media, and using cash instead of plastic is only a partial solution to technofeudalism.

We have not become weak-willed. No, our focus has been stolen.Yanis Varoufakis

Under benevolent socialism, public media would run your newsfeed. You would make micropayments to consume content that informs and enlightens you. Driver-owners would replace the feudalism of Uber and Lyft cars. People would segregate their lives into work zones and social zones to create a clear distinction between being a producer and living an autonomous existence.

Benign Socialism

Varoufakis longs for a system of benign socialism to strip Silicon Valley and Wall Street of their dictatorial power. His insights into big finance are accurate and convincing , as is his complaining and rabble-rousing, and “technofeudalism” is such an evocative term. But Varoufakis’s solutions to the problems he cites seem murky, comprised of idealogy and not all that workable. Yet his simple tactics for lessening technofeudalism’s incessant invasion of your privacy are worth adopting. While not all readers will embrace Varoufakis’s remedies, he raises important points to consider as nonbillionaires fight for a place in an evolving and increasingly oppressive global economy.