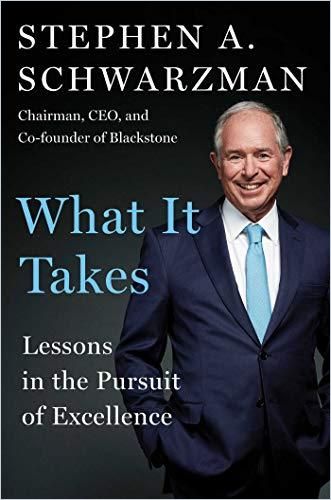

Stephen A. Schwarzman, chairman, CEO and co-founder of the investment firm Blackstone, details his extraordinary career.

Decisive Success

Stephen A. Schwarzman, chairman, CEO and co-founder of the investment firm Blackstone, is also a significant philanthropist active in education and the arts. As a man with little – that is, nothing – to prove, Schwarzman adopts a charming, unpretentious, breezy tone in his autobiography. He describes his meteoric rise in Wall Street finance, attributing his success to his inexhaustible work ethic, analytical ability and willingness to make rapid, tough decisions.

Schwarzman co-founded the Blackstone Group, Inc., which initially embraced mergers and acquisitions, leveraged buyouts and real estate, and grew to become one of history’s most successful international investment companies. While noting his career highlights, Schwarzman offers readers principles of success and leadership and describes his profound commitment to philanthropy.

Success is about taking advantage of those rare moments of opportunity that you can’t predict, but come to you provided you’re alert and open to major changes.Stephen A. Schwarzman

Schwarzman’s fellow business leaders prove unstinting in their praise. Ray Dalio, co-chairman of Bridgewater Associates and a blockbuster author himself, called the book, “the real story of what it takes from a man who could turn dreams into realities.” Former head of the Federal Reserve – now US Treasury Secretary – Janet Yellen described it as “a must-read, inspirational account ”

Though it’s not easy to find someone who’s achieved Schwarzman’s success, insightful companion readings from his few peers include Disney Executive Chairman Robert Iger’s The Ride of a Lifetime and Invent and Wander by Jeff Bezos.

From Ballet to Lehman Brothers

Schwarzman went to Yale University, then an all-male college, in 1965. He started a student ballet-appreciation society which invited dancers from women’s colleges to perform, thus bringing a female presence to the campus. He initiated a program to attract minority students to Yale – a groundbreaking achievement in 1965 and one that reflects his social conscience. He also achieved an on-campus honor, an invitation to join the elite Skull and Bones society. Seeking career guidance, Schwarzman met with a Skull and Bones alumni, US diplomat Averell Harriman. He recalls that Harriman advised him to begin by making as much money as he could to gain the freedom to pursue anything he wanted to do.

Schwarzman’s first job – which he kept for only half a year – was at the Wall Street firm Donaldson Lufkin & Jenrette (DLJ). He then spent six months training in the Army Reserves. Subsequently, he enrolled in Harvard Business School’s MBA program where he discovered his ability to “spot patterns, sense problems and suggest potential solutions.”

After Harvard, Schwarzman joined Lehman Brothers and, he notes with pride, made partner in six years after orchestrating Beatrice’s $488 million acquisition of Tropicana. After an office coup ousted Lehman CEO Pete Peterson, the company’s performance suffered. Schwarzman oversaw the sale of Lehman Brothers to American Express, and left the firm to go into business with Peterson.

Blackstone Group: “Go Big”

Schwarzman and Peterson started Blackstone in 1985. The author explains that the name Blackstone combines “Schwarz” – German for black – and “petros” – Greek for stone. Schwarzman, who always aims for grand targets, set an initial goal of $1 billion for the investment fund. This underscores a major theme: going big and staying decisive fuels success. Blackstone became the leading firm for management of “alternative assets.” These assets, Schwarzman explains, include private-equity funds, mortgage securities and hedge funds.

If you’re going to commit yourself to something, it’s as easy to do something big as it is to do something small.Stephen A. Schwarzman

Hewing to the “go big” philosophy, Schwarzman and Peterson focused Blackstone on M&As. Their first expansion involved leveraged buyouts. Blackstone had raised almost $800 million when they closed the fund on Thursday, October 15, 1987. While this was short of Schwarzman’s goal, the stock market had hit record heights, and he didn’t want to get trapped in a downturn. The following Monday, the Dow fell 508 points.

Spotting Patterns

Schwarzman tactically collects information and uses his analytical gifts to find connections among disparate data. He believes Blackstone’s different businesses perfectly position the firm to suss out unique business opportunities.

The most important asset in business is information. The more you know, the more perspectives you have and the more connections you can make, which allow you to anticipate issues. Stephen A. Schwarzman

Throughout this memoir, Schwarzman demonstrates strategic psychological insight. He believes investors crave the reassurance of following the crowd. As a result, he says, many invest when a market peaks. But, he warns, investing too early may mean long waits for returns. He recommends waiting until prices recover a minimum of 10% from the bottom before investing. He insists that sacrificing the initial 10% to 15% of a recovery nets the best returns. This is only one example of how he delivers solid advice by describing tactics he embraced. His continuing success provides any necessary proof of the merit of his counsel.

Corporate Culture

Schwarzman asserts that Blackstone’s culture emphasizes excellence, integrity and innovation. He regards his firm’s executives as “10 out of 10s.” He holds regular collaborative, information-sharing meetings with them; in fact, you can see one pre-COVID, Monday morning brainstorming session on the company’s website.

No one person, however smart, can solve every problem. But an army of smart people talking openly with one another will.Stephen A. Schwarzman

As proof of Blackstone’s selectivity, Schwarzman discloses that it hires only 0.6% of applicants. He underscores his focus on the human aspect of hiring with his “airport test” for job applicants: He asks himself if he would want to spend hours waiting for a delayed flight with the applicant?

A Titan of Business and Philanthropy

In 2008, Schwarzman donated a jaw-dropping $100 million to the New York Public Library. He alludes to other substantive philanthropic and civic-minded decisions. For instance, between 2013 and 2017, Blackstone and its “portfolio companies” hired 50,000 military veterans and committed to hiring 50,000 more. He also founded the MIT Stephen A. Schwarzman College of Computing and the Schwarzman Scholars program at China’s Tsinghua University.

Schwarzman is a titan of business and philanthropy. He’s not a network titan like Jeff Bezos or a software titan like Bill Gates. Schwarzman made his fortune the old-fashioned way – dealing in the world of pure money. As that world continues to thrive, his saga continues to be relevant, since his advice, decisiveness and courage can serve as models to anyone in any field.

Schwarzman is not self-effacing, but why should he be? To his credit – although many memoirists who’ve achieved far less talk down to their readers – he speaks in an easy, witty voice. His main goal is to offer guidance to the ambitious and that goal, like most of his other goals, he achieves.