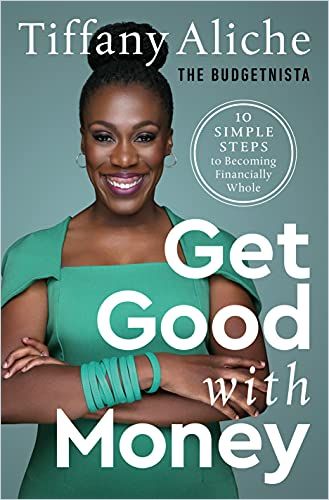

Tiffany Aliche made her name with practical financial advice for people who work for a living; this compendium provides a one-stop guide.

Sound Financial Advice

In this New York Times, Wall Street Journal and USA Today bestseller, Tiffany Aliche – a financial expert on The Real show and co-host of the financial podcast Brown Ambition – offers to be your personal finance educator, “The Budgetnista.” Aliche encourages you to take control of your financial fate, outlines the basics of financial health and provides helpful details on how to save and invest. Her engaging and lively advice complements her website and programs.

Among Aliche’s gifts – her relentless enthusiasm and common sense foremost – is her skill as a teacher. Having served as a pre-school educator, she understands how to simplify fundamental but confusing financial topics for befuddled adults. As Americans cope with tidal waves of debt, Aliche’s advice for becoming debt-free proves timely and relevant.

Financial Calamity

The child of Nigerian immigrants, who provided sound financial know-how to their daughters, Aliche recounts how, in 2009, she faced a mountain of credit card debt from a failed get-rich-quick scheme.

In my twenties, I didn’t realize that you could have expensive things but not really own expensive things.Tiffany Aliche

Feeling like a failure proved more daunting for Aliche than financial peril. As she worked toward financial soundness, she began counseling friends on personal economic strategies. Within a year, Aliche launched her personal brand and business.

Never think, she cautions, that more money means greater happiness.

The author says to build a budget by calculating monthly funds coming in and expenses going out by category. If you have nothing left at the end of the month you are overspending or underearning.

Ask yourself the following question: ‘If I don’t pay this thing, am I going to be unhealthy or unsafe?’ Your answers will tell you what you need to keep paying for.Tiffany Aliche

Aliche insists you can shave expenses. She advises using two checking and two savings accounts to put aside funds for emergencies and investment. She also urges you to automate bill paying.

Just like squirrels save food for winter, Aliche reminds you to sustain an emergency fund that covers six months of expenses. Craft a “noodle budget” in case you suffer calamity and must subsist on instant noodles. Her most succinct and applicable guidance is to consider each purchase by asking whether you “need it…love it…like it…[or] want it.”

Debt Repayment

To tackle debt, Aliche recommends you learn how to read your credit card statement and remember to negotiate with debt collectors to restructure debts or gain a lower interest rate.

Work on credit card debt first, because it is the most expensive kind. Put federal student loans on deferral or forbearance, and never, ever, Aliche maintains, refinance them. If you receive money out of the blue, pay down your debts.

High Credit Score

Aliche admits that credit reports can be confusing, but they are worth understanding. She reveals that having a good credit score can lower costs and fees; a score of 740 is adequate.

Get a copy of your credit report and check for mistakes in the payment history record, where 20% of Americans suffer errors. By removing incorrect items from your credit report and managing your finances, you ensure nothing negative appears in your credit report.

Maximizing Income

Aliche encourages you to ask for a raise at your current position. If you start a new job, research the market and ask for your highest possible starting salary, because future raises ascend from that figure.

Take additional training in your field to boost your earnings. To create a side hustle, Aliche advises searching Google Trends to see for which of your skills people might be willing to pay. Treat this research as a money-earner, not a hobby.

Senior Years

You must put in a lot of work to achieve a successful retirement, so determine how much money you’ll need, how to invest and whom to trust with your money. Starting to save late is better than not starting at all. Always set enough aside to obtain any matching funds your employer offers.

It’s your younger self’s job to look after your older self.Tiffany Aliche

Retirement funding vehicles include 401(k)s and IRAs, and each comes with restrictions. Index funds offer an alternative for reasonable returns without high fees.

Postpone investing to gain wealth until you are current with your expenses, have paid down your debts and amassed an emergency fund.

Good Insurance

Health insurance, life insurance, disability insurance and home and car insurance mitigate financial risk. Regard life insurance, Aliche says, as a means to manage risk, rather than as an investment.

Regarding auto insurance, for example, the author notes that your driving record and your location can increase your rate. Homeowner’s insurance, she details, covers damage to your abode and damages someone might claim if they suffer an injury on your property.

Money Team

Aliche recommends comparing what you have with what you owe and assembling a team of financial advisers, accountants and lawyers to manage your money. She explains that a financial adviser differs from a certified financial planner (CFP). Fee-only advisers receive no commissions and have a fiduciary responsibility to their clients. Aliche advises interviewing multiple candidates.

Estate Planning

Aliche urges you to specify beneficiaries for each of your financial accounts and life insurance plans.

You need to ensure that you are not just the boss of your life, but also the boss of your legacy.Tiffany Aliche

Use the lists of assets you made for calculating your net worth when writing your will. If you own a business, get a separate power of attorney for it. Formulate a long-term care plan. This shows financial maturity – so do it!

Review

Aliche’s belief in financial education for all manifested in her co-writing a bill – that became law – mandating teaching financial basics in New Jersey middle schools. Her charming, authorial persona is a teacher; Aliche carefully instructs, step-by-step, and writes so you do not progress to more complex issues until you master the fundamentals. By describing her own financial mishaps, Aliche ensures she never talks down to readers nor shames them for their own mistakes. Indeed, much of the book explains – with real-world practicality – how to dig yourself out of any financial hole you might currently occupy. Articulate, enthusiastic and precise, Aliche offers priceless advice.

Tiffany Aliche also wrote The One Week Budget; Live Richer Challenge; Live Richer Challenge: Credit Edition; and Live Richer Challenge: Savings Edition. For her worksheets and resources, visit getgoodwithmoney.com.